Some of you might have had front row sit to our journey and evolution. And to be honest that painful evolution continues till today. And that unquenchable desire to address the pain and suffering we witnessed and experience through 2008 social-economic processes that still takes place around the world in some form.

— that act just seems heartless & vicious to fellow man has motivated us.

All that pain caused by those few at the top who seem to think the blessings from capitalism are simply due to them alone and not to men & women who toil 24/7 without equity in their contribution. Part of our goal with this fund is to support more people who’d have had unconventional upbringing, unconventional education, experiences….support more communities, support the technology that will enrich lives. Plus obtain significant monetary and non-monetary ROI.

Manny Omikunle

ROI

Obviously we’d be leveraging the initiative and relationships that have made us stronger today. Thank you to GREATESTFOUNDERS™ / Founders Under 40™Group / MBVIM BJM MARKETING / MBHVIM REI / Venture Capitalist / Angel Investors / Founders / Entrepreneurs / Leaders / Communities

ABOUT THE INVESTMENT FUND

This Fund: (the name of “Fund”) under a management investment company formation could be formed with $25 Million USD.

***As we explore this opportunity, investment thesis, strategy. . .this fund post page is at the moment simply for information, educational, and exploratory purpose.

Investment Objective: The Fund’s investment objective is to seek long-term growth of capital and provide an approach to good social responsible capitalism. By investing in opportunities in diverse assets that address challenges however may be limited to certain sectors. There can be no assurance that the Fund will achieve its investment objective or a ROI.

Interval of Fund: The Fund is designed primarily for long-term investors who have the option to be active investors.

Minimum Entry: (Please reach out)

Structure: (Please reach out)

Advisers: (Please reach out)

Management: (Please reach out)

Securities Offered: (Please reach out)

Expenses: (Please reach out)

Risks: (Please reach out)

Fund Use: (Please reach out)

Investment Opportunities & Strategies: (Please reach out)

Partnerships: We aspire to work with companies, for profits, nonprofits, and local governments to improve the community, making a difference, as well as making ROI. (Please reach out)

ALLOCATION OF FUNDS

The fund will primarily be open to domestic companies in North America and some foreign (like Mexico) in exchange for equity securities of companies that are relevant to the Fund’s investment theme of benefit to all of humanity and improving quality of life.

While hopefully minimizing social & economic disparity. minimized the nonconstructive aspect of AI Robotics Revolution.

Areas of Interest: Batteries, Document Management, Space Industry, Space Commercial Goods and Services, Building Info Management Systems, Real Estate, PropTech, Reusable, Cybersecurity, Finance, AI, Humanity Archive, Home Renovation & Improvement, Material Recovery, LifeTech to help people hit goals, Personal Development, Smart Factory, Knowledge Management, Analysis, Forecasting, Quantum Materials, AI Best Friends, Boosting Human Intelligence, Human Enhancement, Brain Data Copy, An Internet for AI, Systems To Make Sure AI is In Check, AGI, AI Builds Other AI, Skill Training, Finance, Water, Sanitation, Community Management, City Management, Product Management, Scaling Management,

- It could be the development of new products or services, technological improvements and advancements

- Innovation in automation and manufacturing

- Transportation

- Energy

- Artificial Intelligence

- Financial Services like FinTech

- Consumer Discretionary

- Web3.0

- Technology Infrastructure

- Hardware and Software

- Warehouse Technology

- Individual & Community Development

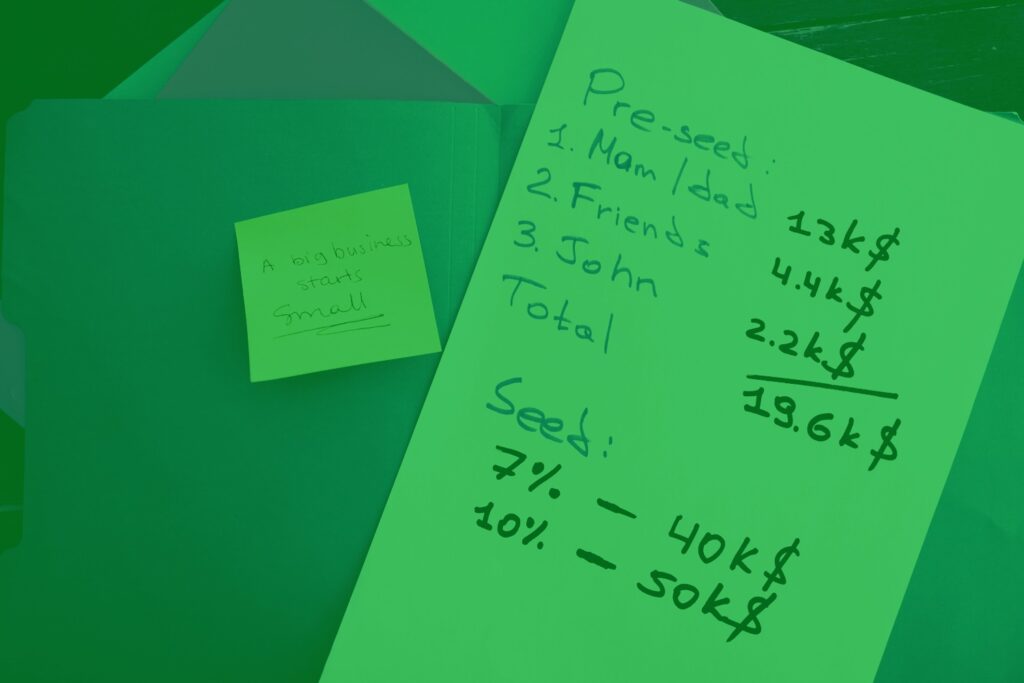

FUND SOURCES

Usually fund sources are likely from typical sources like contacts, crowd, pension, family office, institutions, high net worth individuals,

ADDITIONAL INFO & APPROACH

We will use the top analyst talent to select investments for the Fund that represent the highest-conviction investment ideas. Work with knowledgeable experts to pick genuine business ideas and not just speculations.

Effort to fund / invest with companies with favorable ESG characteristics however it will not be must have attribute. We will simply invest with founders & the teams who demonstrate good social & economic values however still come down to best risk-reward opportunities.

The Fund’s investments will include early- to late-stage private companies from tiny, small, medium and large companies.

There are many risks and rewards. Many threats and opportunities. Many social economic unrest brewing in the background of every city, nation when it comes to wealth gap, housing crisis,…

Our pre-investment evaluation process will consider: People, Team, Support, Values, Go-to-market strategy, Ownership, Business Process, Timing, Exit, Market Size, Recruitment, Risk Management, Milestones, Market Proof, Systems, Pricing, History, and Our Unconventional Tests